Instantly Analyze & Verify Loan Documents

Our AI-powered platform automates loan analysis, ensures regulatory compliance, and generates MISMO XML data, empowering you to close loans faster and with greater accuracy.

No credit card required

A Revolution in Loan Processing

Cerebra delivers a suite of powerful, automated tools designed to eliminate manual work, reduce errors, and accelerate your entire loan origination workflow.

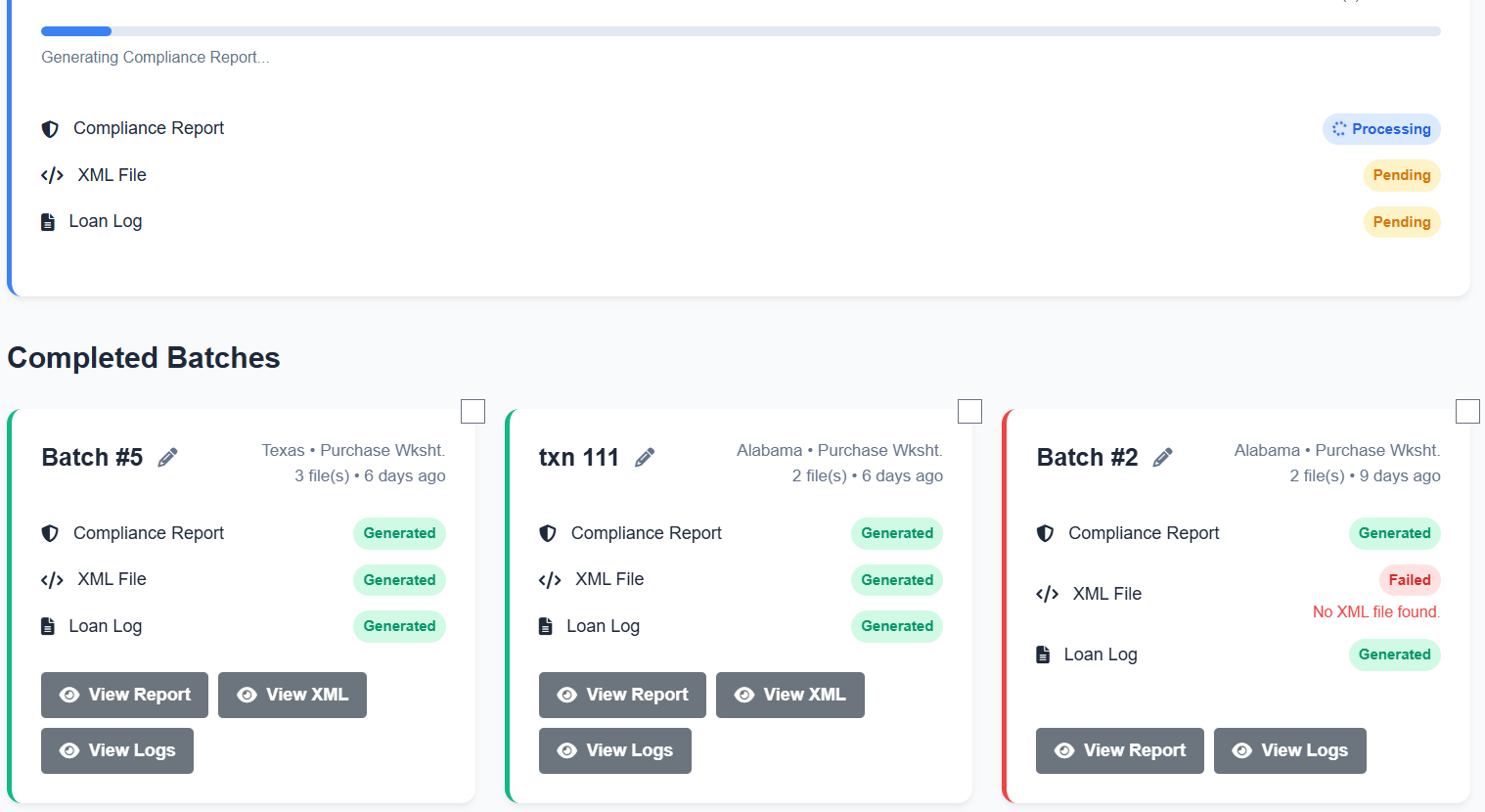

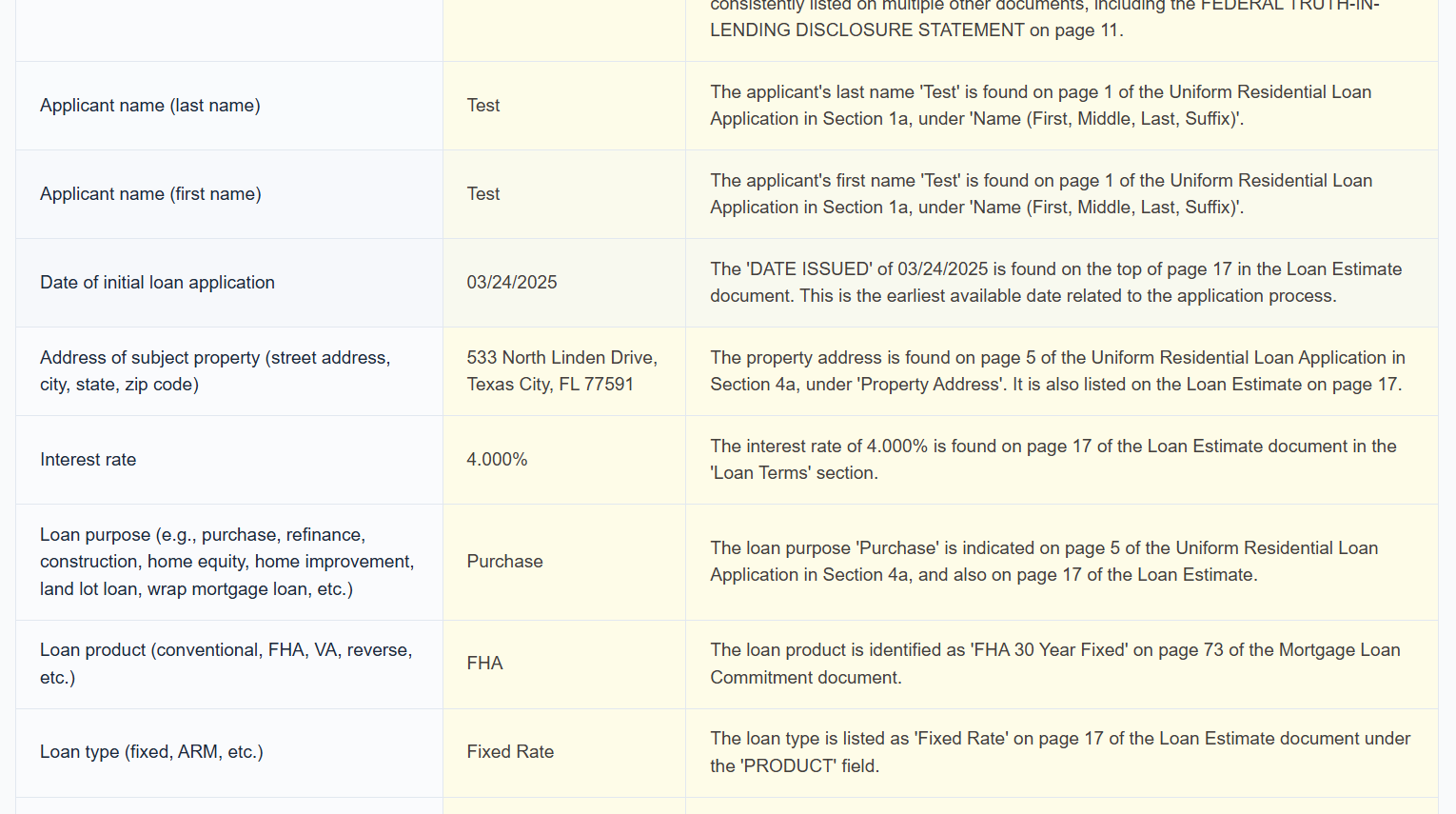

AI-Powered Compliance Analysis

Instantly upload loan packages and receive a comprehensive compliance report. Our AI meticulously audits documents against TRID, QM, and other critical regulations.

- End-to-End Document Auditing

- TRID & QM Compliance Engine

- Proactive Risk Flagging

- Actionable Compliance Summaries

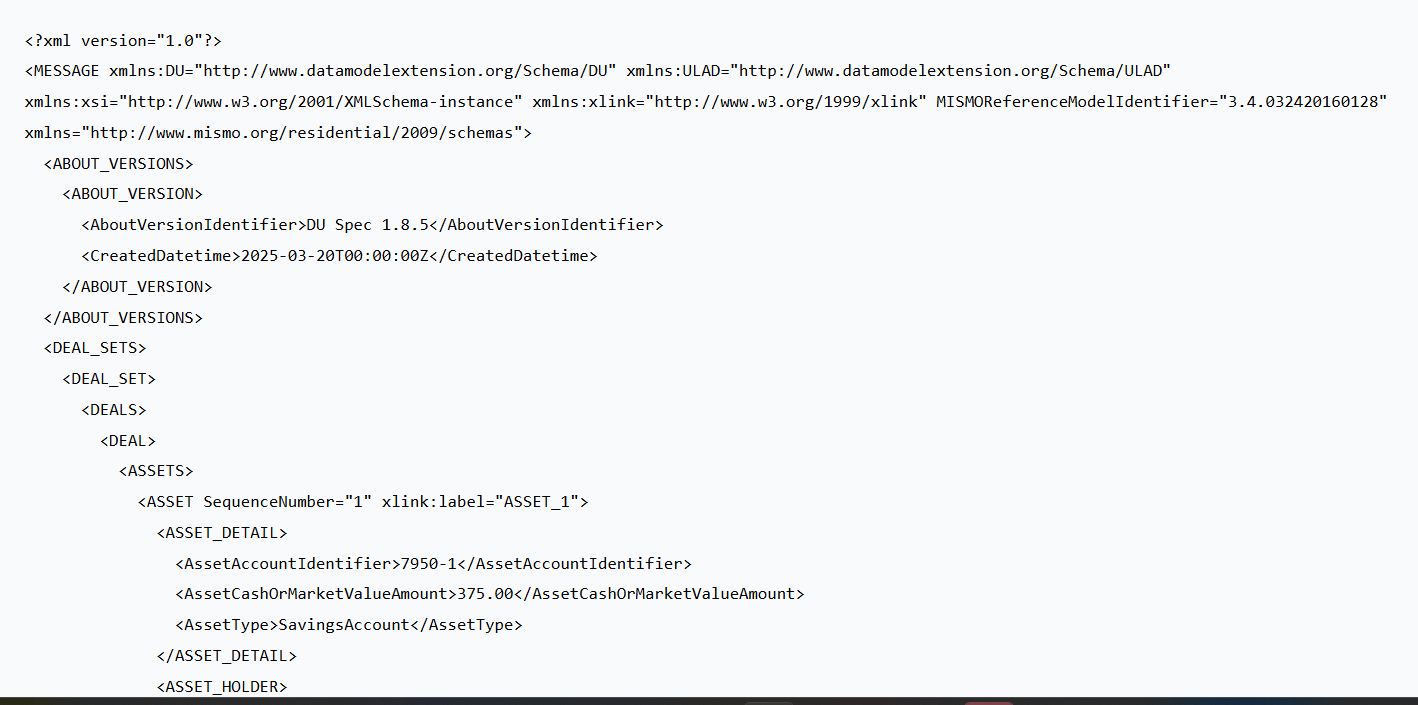

Seamless MISMO XML Generation

Effortlessly convert loan data into a validated, industry-standard MISMO 3.4 XML file. Ensure seamless integration with investors, servicers, and regulators with one click.

- Latest MISMO 3.4 Standard

- Intelligent Data Extraction

- Built-in Validation & Error Checks

- Scalable Batch Processing

Generate Loan Logs

Extract loan logs from your loan file to keep it for record.

- Complete Lifecycle Logging

- Time-stamped Event Tracking

- Granular User Activity Logs

- Instantly Searchable Archives

The Cerebra Advantage

Accelerate Turn Times

Slash manual review hours by up to 90% and focus on closing more loans, faster.

Mitigate Risk

Our platform is continuously updated with the latest regulations, minimizing costly compliance errors.

Increase Profitability

Eliminate the high costs associated with manual errors, compliance penalties, and inefficient workflows.

Transform Your Loan Origination Workflow Today

Experience the future of mortgage compliance. Sign up for your free 14-day trial and discover how Cerebra can enhance your team's efficiency, accuracy, and profitability.